Mswipe to acquire PayU’s offline POS business

Mobile point of sale (PoS) solution provider Mswipe Technologies and PayU, India’s leading internet payment service provider have entered into a strategic agreement for digital payments. As part of this arrangement, Mswipe will merge PayU’s offline POS division team into its existing operations. This will expand its network to 2,20,000 terminals, across over 550 cities with a combined team strength of 2,000 plus employees.

This strategic partnership will allow the merchant base of Mswipe to leverage various internet payment services offered by PayU India. Again, PayU’s merchants will have access to Mswipe for any POS related requirement.

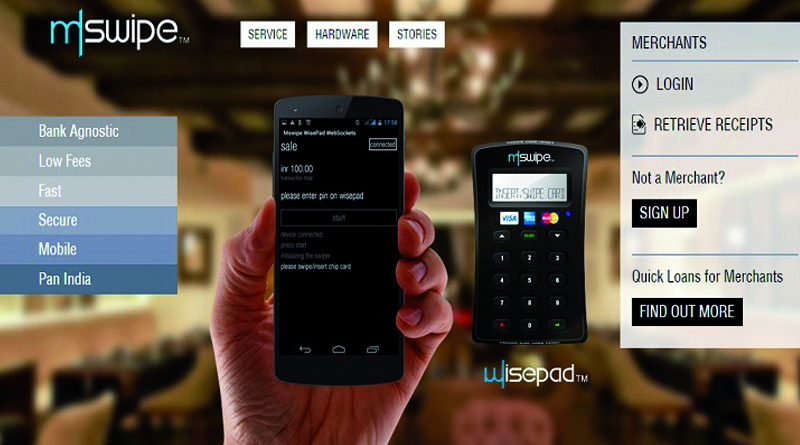

Mswipe, a PoS service provider, was launched in 2011 by Manish Patel. Apart from the POS terminals, it also allows merchants to undertake card payments through smartphones. The company witnessed a huge growth in the sales of these devices post demonetisation, with card transactions growing rapidly.

Mswipe raised US$21 Million of Series D funding from Chinese VC firm Fosun in April this year. Existing investors Falcon Edge Capital and DSG Consumer Partners have also participated in the funding round. Previously in July 2015, it has raised US$25 Million of Series C funding from Axis Bank, DSG Consumer partners, Flacon Capital, Matrix Partners India and Meru Capital.

PayU India started in 2011 and has over 250 payment methods and PCI (Payment Card Industry)-certified platforms. PayU India acquired Mumbai-based Citrus Pay for US$130 million in September 2016 in the largest ever cash deal in fintech space.

The Indian fintech space is heating up with a wide variety of players including merchant services, consumer payments, lending firms, insurance firms, etc. vying for a pie of this market.