BHIM Aadhar Pay: The credit card killer

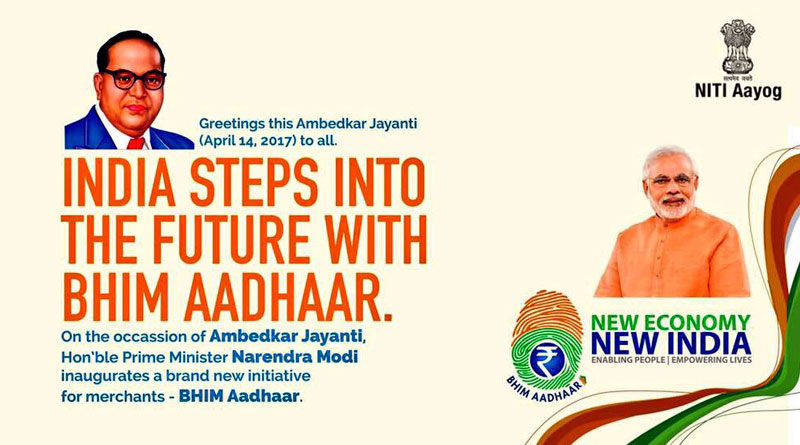

Prime Minister Narendra Modi launched BHIM-Aadhaar platform for merchants on Friday on Bhimrao Ambedkar Jayanti. BHIM-Aadhar platform is a biometric-based payment system. It will allow users to make payments through the fingerprint scanner, by authenticating the biometric details of a user with Aadhaar database. The app’s predecessor BHIM, also known as Bharat Interface for Money, was launched three months ago as a tool to carry out peer-to-peer digital payments.

Aadhaar Pay is the merchant version of the Aadhaar Enabled Payment System (AEPS). It will especially be beneficial for people in remote areas who do not have access to debit cards, mobile wallets and mobile phones. The users who wants to pay using Aadhar Pay only need to link their Aadhar number with their bank accounts. Once the linkage is done, they can just identify themselves by using the fingerprint scanner, adding their account number in the machine and choosing the account from which they want to pay.

In order to encourage merchants and customers to use this scheme, government has also introduced two reward schemes as well. One is BHIM Referral Bonus Scheme (For Individuals) and other is BHIM Merchant Cashback Scheme for merchants.

BHIM-Aadhaar platform will offer multiple benefits not only to merchants but to customers as well. First, it will save them from excessive credit card and debit card related fee. Secondly, there will be no service tax or any other extra charge on the payments. Also, all the hassles related to carrying debit card or credit cards such as remembering PINs, MPINs and passwords will be eliminated.